Which payment gateway should you use for your e-commerce store? Many are struggling with this question. After all, payment gateways and online payments can be generally intimidating, especially if you are new to around the block.

With dozens of online payment options to choose from, you can make complex decisions. However, this guide begins. Here, we tell you what to look for in a quality online payment gateway and here are the top ten best solutions on the market .

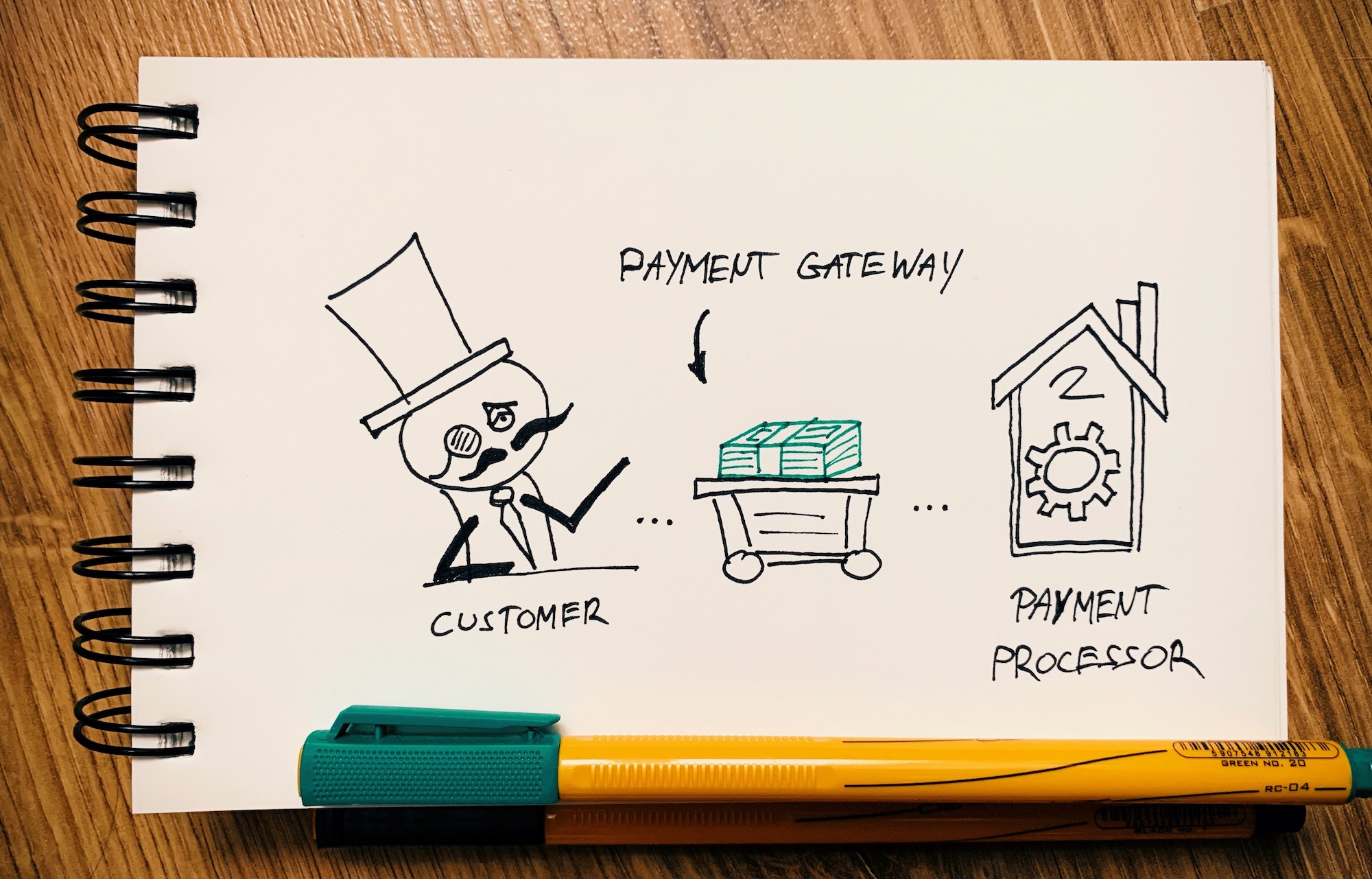

What is a payment gateway?

A payment gateway is an intermediary between an online store and a payment processor that receives payments from customers.

This means that when a customer enters payment details on your site, the payment gateway securely sends that data to the payment processor.

You can think of it like this:

Confirm that the data entered is sufficient to complete the payment by the payment gateway processing payment authorization . The gateway protects the details of your credit card by encrypting all the sensitive information it holds. This process ensures that payment is transfer online between customers and sellers.

Payment gateways are part of the “magic” that happens in the background when transactions occur on the web. It’s the basic building block that allows your e-commerce store to work by sending information securely between your website and payment processing and then returning transaction details back to your website.

If you have a (e-commerce) website and are interested in paying by credit card online, you need a payment gateway. Effectively connect product sales and customers.

How does the payment gateway work?

The good news is, as an ecommerce store owner, you don’t have to understand how payment gateways actually work. In fact, you just need to choose a gateway and then integrate it with your online store, usually through a user-friendly setup wizard. After that, it works and you can collect payouts from customers.

However, let’s take a look at the steps taken in general to give you an idea.

- Customer orders from the website. They enter the shopping cart, process the payment, and enter payment information.

- The payment gateway takes the payment information, encrypts it, and sends it to the payment processor through a secure channel.

- The customer is redirected to the payment processor.

- The payment processor guides the customer through the steps to complete the payment.

- The payment processor verifies that the payment was successful and displays an appropriate message to the customer.

- Customers can return to the online store.

What this really means is that the payment gateway is responsible for allowing the customer to communicate with the payment processor. A gateway, as the name implies, is a “gateway” that brings customers’ personal information to a payment processor through a secure channel.

How to choose a payment gateway

Here’s what to look for in your payment gateway:

From a technical point of view, there are three ways to get payment details from a customer.

- Payment form on the site, details posted on the server. From a customer’s point of view, the smoothest payment experience is to enter payment details in the usual format of the site. Unfortunately, this requires very serious security precautions to be taken in order to keep working in the safest way. PCI compatible. Unless you’re making millions of dollars per year, this isn’t the solution.

- iFrame or redirect. Instead of receiving payment details directly from your site, you can embed a payment form inside a secure iFrame within a page on your site, or redirect customers to a hosted external payment page. With this approach, it’s harder to get a payment form that matches the rest of the website, but it’s the safest way.

- Payment form on the site, details sent directly from the browser through a secure payment gateway without going through a server . This is a form of intermediate solution. This is actually how most modern payment gateways work. Stripes for example. Stripe allows customers to enter their card information into a form on the site, but the data passes directly to Stripe’s servers through a secure channel. Customer’s credit card information never goes through the web server.

There are two different payment gateways and payment processors ( more on the differences ). You’ll need both if you want people to actually be able to buy things in ecommerce stores. If you can’t afford a merchant account, you can handle credit card payments yourself (usually not a solution for small and medium-sized stores).

That said, it is very common for a single company to not only provide a gateway, but also handle the payment processing part. This facilitates integration and minimizes setup complexity.

Payment providers like PayPal and Stripe provide these unified payment gateways and processor settings (I’m actually using a merchant account).

At the same time, some payment providers such as SagePay or PayPoint only offer a payment gateway (a technology that sits between your website and the payment processor). They ask you for your own merchant account .

As I said, getting an account through one of the “combined” providers tends to be easier than getting a merchant account, and it tends to cost less to install and lower monthly fees. However, fees per transaction tend to be higher. For this reason, small sellers can start with a combined payment provider. Large sellers can usually save money by having their own seller account.

This is perhaps the most surprising element in this whole discussion.

For clarity, you can actually use more than one payment gateway in an e-commerce store.

What’s the reason?

simple. Customers may prefer to use a different payment gateway. What this really means is that customers won’t buy unless they provide their preferred payment method.

The most popular, must-have payment gateway undoubtedly PayPal. PayPal is available in most countries around the world, so you can sell it internationally. Many consumers have PayPal (read the full story) PayPal Review ) accounts and many of them prefer to pay with PayPal instead of entering their credit card information on other websites.

Even if you don’t use PayPal as your default payment gateway, it’s a good idea to offer PayPal as an alternative way for your customers to pay. Even if there is a problem with the default payment gateway or merchant account, the backup can be fine.

Payment gateways and merchant accounts charge a variety of fees, including monthly fees, fixed fees per transaction, variable fees as a percentage of the amount, chargebacks, and additional fees such as international card payments.

Always double check that you understand the pricing scheme before committing to the gateway in the long run.

At the most basic level, you can usually expect to pay around 2.9% + 30¢ per transaction. Anything less than that is great!

Historically, some payment providers have been known to lock sellers on long contracts of more than two years. After signing up, it can be a problem if you are not happy with the provider for some reason. Other providers will please the seller to use the seller with a monthly rolling contract or no contract at all.

These long-term contracts are usually the domain of small payment gateways.

Anyway, you should always understand the kind you want to sign up for. Please check the rules and regulations of your payment gateway before signing up.

This is a fairly obvious question, but it can be difficult to identify when reading reviews on the web.

In fact, no matter which payment gateway you choose, there are always a lot of negative reviews. There are at least two reasons.

- Payment gateways process millions of payments per year. Sometimes, some of those payments will fail.

- People are generally more vocal when not happy about something as opposed to when everything goes well.

This means payment processing is very important to your business, so you’ll want to work with an overall reputable provider in the industry.

Some payment providers had problems with power outages. Others have gained fame in some circles for blocking traders’ money without good cause. If you haven’t heard of a specific payment provider before, pay a little attention before signing up.

In general, it’s okay as long as you choose the large payment gateways and processors on the market.

Not all payment gateways are the same. You just need to process a one-time payment. However, sometimes you may need a gateway to do more.

Would you like to charge a recurring payment? This is useful if some products are subscription based. Alternatively, you may want to act as a marketplace and make payments on behalf of sellers who post products on your site. Most payment gateways are quite limited in the features they offer, so make sure the payment gateway you are considering has the features you need.

There are a number of online payment methods in use around the world, from well-known and well-established cards such as Visa and MasterCard to very niche payment methods used in one or two countries.

Each payment gateway supports a different set of payment methods. Know which payment method people in your target market are using and choose a payment gateway that supports that method. If the website does not accept the customer’s preferred payment method, the sale will stop.

Take a look at competitors’ websites to see what payment methods they offer.

Some businesses are considered high risk by payment providers. This is usually due to the sectors they operate. Some of the high-risk sectors include:

- gambling

- Adult content

- Trip

- tobacco

- Debt collection

- Electronic cigarette

- Credit repair

- MLM

If your business is one of these niches, you may not want many payment providers to work with you. In these cases, you need to work with a supplier specializing in the processing of so-called’high risk’ payments.

Five popular payment gateways to consider

The most popular payment gateways on the market, their pros and cons, and their associated costs are:

Reference. Check out all of the payment gateways discussed below . This is why there are only three here.

1. Pay Line

Payline has been in the payment gateway business for some time. They offer clear commissions and profits in the exchange plus pricing model .

If you mainly want to accept credit cards, this might be your best solution. In this model, you are charged according to each card’s associated transaction fee and operator fee.

This means that you will need a separate merchant account using Payline to make the setup process more complex and less familiar. New e-commerce store .

Payline is your responsibility to set up more real payment gateways , recurring payments or other non-standard payment schemes. This means that implementing a specific solution can be more complex, making it more suitable for your existing business.

price:

- Due to the Interchange Plus pricing model, you will be charged the cost of the specific credit card being processed + 0.3% of the transaction amount (if you have enough, the fee amount can be negotiated at 0.2%)

- There is a fee of $10 per month to continue using your account.

2. Stripes

Stripes has been one of the most popular payment gateways in the market for a good few years. The clear fee structure, good integration with all major e-commerce systems, and an easy-to-use interface have helped Stripe build a happy customer base.

Stripe is probably a developer-centric payment gateway. This may sound intimidating to some, but what it really means is that you can fine-tune Stripe to do your business exactly the way you want it.

With Stripe, you can process one-time payments, repeatedly bill your customers, set a market, or process payments yourself.

Stripe also ensures transaction security and stores all credit card numbers and transaction details in a secure way (with a good AES-256 encryption key).

Besides:

- Stripe is PCI DSS Level 1 Certified

- SSAE18/SOC 1 type 1 and 2 report issues

- Money transmitter licenses across the US, AFSL in Australia, E-Money licenses in Europe, and MSB registration in Canada

- Compliant with PSD2 and strong customer certification (SCA) in EU

- Compatible with more than 135 currencies

- Currently available in over 30 countries

- Works with numerous third-party tools and platforms-Read: Ensure collaboration with e-commerce providers

Best of all, it comes with 24/7 support via email, chat and phone.

Price :

- 2.9% + 30¢ per credit card transaction amount in the US

- +1% on international card acceptance

3. Authorize.Net

Authorize.Net is one of the best known and the oldest payment gateway works on the web. They have existed since 1996 and have allowed businesses of any kind to accept both the web and direct payments.

Authorize.Net accepts credit cards, contactless payments and electronic checks.

It also has advanced fraud detection, helping you save your business from unauthorized payments or other payment related issues.

Depending on your business needs, you can use Authorize.Net to issue invoices, set up recurring payments, and use a simple payment process.

price:

- All-in-one option: for businesses without a seller account; $25 per month and 2.9% + 30¢ per transaction

- Payment gateway only: for businesses that already have a merchant account; $25 per month and 10¢ per transaction

- Enterprise solutions for businesses that process more than $50 billion annually

4. Paypal

PayPal is the best known payment processor / payment solution / payment gateway .

PayPal is more than just a gateway for business owners to integrate with ecommerce stores. In fact, many casual users have their own PayPal account, and you can also use this service to process casual payments on the web or split bills with friends.

All of this makes PayPal an essential payment gateway for e-commerce stores. Purely because it’s the only solution that can sell your product to everyone.

- Paypal payment standard

- PayPal Express Checkout

- Paypal payment pro

The difference between the three may be fine, but it can vary greatly depending on the type of product you sell.

PayPal payment standard and PayPal Express Checkout work very similarly. The only difference is that with Standard, customers create orders on your site → customize them → redirect them to PayPal for payment.

With PayPal Express, customers are redirected to PayPal to approve the claim, but do not complete the payment process. Instead, you can return to the site, customize your order, and then charge in the background without leaving the site.

With PayPal Payment Pro, you can customize the entire payment process and your customers stay on the site for the entire time. Currently, PayPal Payments Pro is only available in a few countries.

Some important details about PayPal as a payment gateway:

- You don’t need a merchant account to use PayPal

- You get advanced fraud protection

- Can issue an invoice

- You can quickly withdraw money to your bank account in local currency.

price:

- PayPal Payment Standard: 2.9% + 30¢ per transaction; There are bulk discounts if you process a lot of payments.

- PayPal Express Checkout: 2.9% + 30¢ per transaction

- PayPal Payments Pro: 2.9% + 30¢ per transaction; $30 per month

5. 2 Check out is now Verifone

2Checkout started in 2006 and currently serves over 180 countries.

It provides a complete solution to process online payments, giving you access to an advanced platform to manage your business finance and e-commerce efforts.

One of the unique features of 2Checkout is that, in addition to being able to integrate your payment gateway with all popular ecommerce platforms, you get access to a hosted shopping cart that has been optimized with all best practices in mind. conversion. This allows you to work with just 2Checkout without an external e-commerce solution. It can be an attractive option for businesses that don’t yet have an ecommerce setup.

Other important details about the 2Checkout offering:

- Works in 29 languages and 100 currencies

- Localized payments for supported countries

- Integration with more than 120 e-commerce tools

- Can accept all major credit cards and PayPal payments

- “2Comply” add-on provides advanced tax and VAT handling and compliance

price:

- “2Sell”: an easy and simple way to sell worldwide; 3.5% + 30¢ per transaction

- “2 subscription”: affiliate business; 4.5% + 40¢ per transaction

- “2Monetize”: An all-in-one solution for selling digital products around the world. 6% + 50¢ per transaction

This price may seem more expensive overall than the other solutions on the list, but there are a lot of extra features that act as simple payment gateways, especially in the latter two plans.

summary

This was the first lesson on what payment gateways are and the top ten gateways available on the market.

At the end of the day, each customer can collect payments equally and effectively from the customer. The real difference lies in the features offered and overall experience with gateway usage and integration with e-commerce repositories.

With these payment gateways aside, there is one more thing to consider before your e-commerce setup is complete, especially if you plan to use multiple currencies.

Basically, the problem with accepting multiple currencies is that they often lose various conversion fees when trying to withdraw funds or process them in general. For this reason, we recommend complementing the payment gateway. TransferWise for business.

TransferWise is a truly innovative financial service. Basically, it provides local banking information for the UK, Eurozone, Australia and the US (no local address required). This means you can ask for payments like a local wherever you are. You can then withdraw money for a low commission to minimize currency conversion costs.

TransferWise works in different ways too, so it’s the best way to pay invoices and send other payments to vendors around the world.