The striped payment processor has a romance behind it. Not only does it have famous clients like Lyft, Target, and Warby Parker, but the impressive team of co-founders certainly brings the charm. In this Stripe review we will check if Stripe is cracked.

There is a lot of hype behind the Stripe company, and as a third party, they offer payment processors , top-notch development tools, security measures, and international business modules. Online commerce .

The point is to make stripes easy for anyone to do business online . If you are running a subscription-based model, Stripe covers it. If you want to make your shopping cart unique, Stripe is here to help.

Also Read: Stripe Vs Paypal

Plus, Stripe’s price is a flat rate, so you don’t have to think too much about what the company pays.

Stripe review: summary

Stripes, like most payment processors, aren’t perfect. However, the experts are definitely more important than the downsides, so we’ve put together a quick list of reasons or reasons not to consider Stripe for your online business.

Backwards :

- The subscription function is easy and powerful.

- Stripe supports the marketplace.

- International sellers should have no problems with Stripe.

- The report is easy to understand and comprehensive.

- The flat rate is transparent and not to be confused with many competitors.

- The development tools are excellent for advanced customization.

Disadvantages :

- Stripe does not support high-risk industries and countries.

- There is no direct phone support line.

- Stripe provides its own infrastructure for everything. Violation of these terms may result in arbitrary account suspension.

- Many tools are suitable for large enterprises. This is great for scale-ups, but sometimes I get the feeling Stripe cares about the behemoth the most.

Stripe Review: Where Can I Get It?

Stripes are available in over 26 countries at the time of writing this article. Most of these countries are in Europe and America, so if you live in Russia, most of Asia, Africa and the Middle East and Eastern Europe, you should look elsewhere.

I argue that location restrictions are one of Stripe’s biggest drawbacks, but from a business point of view, Stripe is trying to avoid some of the world’s highest risk locations.

Stripe recently released a private beta for India. Therefore, payment processors are trying to expand into potentially more risky markets and are looking for ways to serve sellers around the world.

The countries where Stripe can be used are:

Brazil and Mexico are on this list, but you must ask for an invitation before getting approval. If you operate your business in the following countries, you should have no problems registering an account immediately.

- Australia

- Austria

- Belgium

- Canada

- Denmark

- Finland

- France

- Germany

- Hong Kong

- Ireland

- Japan

- Luxembourg

- Netherlands

- New Zealand

- Norway

- Singapore

- Spain

- Sweden

- Swiss

- England

- USA

- Italy

- India (beta)

- Portugal

The stripes have been increasing over the years, so you can subscribe to email notifications and specify the country. Then, Stripe sends an email as soon as it starts in that country. The only problem is that Stripe launches may not occur in that area.

So, if Stripe isn’t available, you should look elsewhere at this time.

If you are in an unsupported country but still want the advantages of Stripe, a program called Stripe Atlas is offered to set up your online business as a company integrated into Delaware.

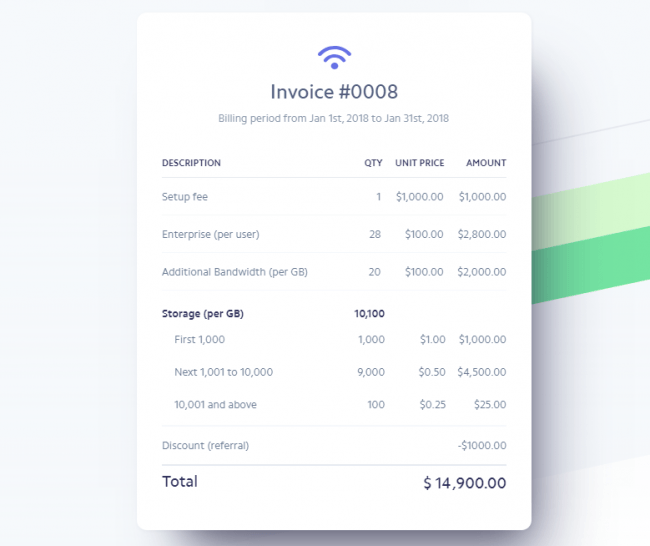

The program has a one-time fee of $500 and an annual renewal fee of $100 for Delaware Registered Agents. Finally, there is a fee of $25 per month to maintain a U.S. bank account.

US business is desirable for several reasons, and Stripe’s security and ease of use can make this venture worthwhile for some businesses in high-risk countries. However, it is only available for online businesses. You cannot access Stripe Atlas from retail stores.

Unique European payment method

As you may have already assumed, Stripe offers great food for American and European stores. Another way this is done is to support European payment methods that are popular with both European and US sellers. Some of these include Sofort, EPS, P24, Bancontact and Giropay.

Stripe Review: Basic Products and Services

The Stripe brand tries to make their packages and services as simple as possible. When you land on a website, you might be wondering how it can be so basic.

Stripe does this by categorizing its products and services into two categories: payment processing and developer tools.

However, when you start looking at the features of each of these categories, there are far more features than the two.

Stripe Review: Payment Processing Category

As mentioned earlier, payment processing tools are available in 25 countries around the world. However, because Stripe accepts more than 135 currencies, it still works well for international business in these regions.

So, while you may not be able to run your business with Stripe in Vietnam, US or German businesses may collect Vietnamese dong as a payout.

Payment processing is provided immediately to companies operating in approved countries. It’s similar to PayPal, which allows you to integrate third-party processing tools into your online store. This instant access to payment processing is good and bad.

The good thing is that you get approval almost immediately. The bad thing is that when doing business, your account is eventually evaluated. So, if you don’t like Stripe, you’ll see your account closed.

On the other hand, regular merchant accounts are reviewed prior to account setup. So, if you are worried about closing later, a merchant account is a better fit.

Stripe Review: Developer Tools

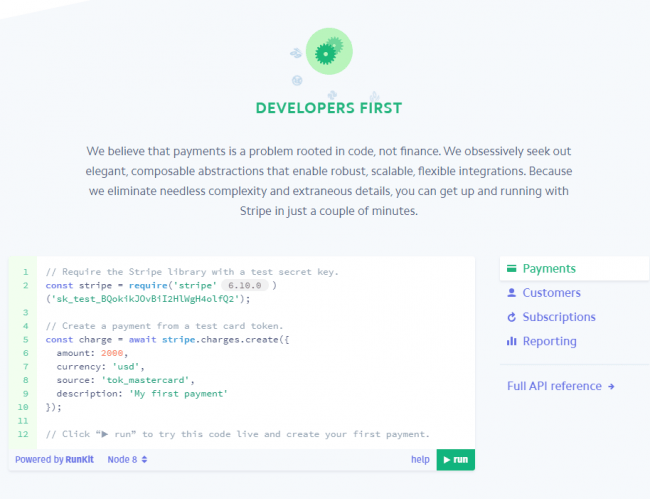

This partial stripe payment processor sets it apart from other competitors. This is one of the reasons many large companies partner with Stripe because their processing systems can be customized and scaled as the company grows.

For example, you can get started with Stripe without writing any code. This gives you access to more than 500 Stripe ecosystem partners, speeding up the entire process.

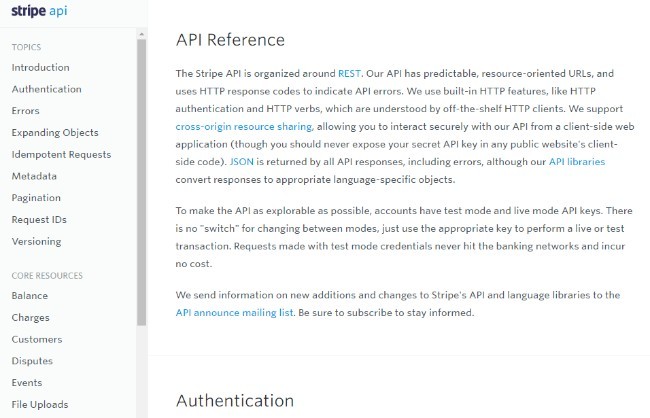

Stripe provides access to an API (application programming interface) that allows developers to sink their teeth into programs and integrate Stripe into their own website. The developer can then use programming languages to adjust the processor behavior and appearance.

With Stripe documentation and open APIs, complete control is a desirable environment.

So, while some online sellers may only need payment processing assistance, many others are interested in development tools. In any case, each category includes a variety of different products and services, such as:

- Stripe Checkout Module -We talk about Stripe Elements (see below), but it’s basically a quick way to organize your checkout to your liking (using pre-built components). Design and launch payments quickly. In short, PCI compliance is complete and you can checkout for your website without any complicated design tools.

- Subscription Tool -PayPal charges for subscription services, but not Stripe. That said, running a subscription site can offer multiple tiers, plans and subscriber types.

- Stripe Billing -This stripe module provides a streamlined set of tools for creating and managing subscriptions. You can also test prices, send custom invoices, and create repeatable business relationships.

- Stripe Relay -Relay products combine mobile app commerce with online stores. So, if you want a standalone app, you can upload products from your website and collect payments just like paying through a regular store.

- Stripe Radar 2.0 -Most online payment processors have some kind of fraud detection, but Stripe takes it to a new level. Stripe stands out quite a bit because fraud is so common in online businesses. Now in its second version, Radar uses machine learning to identify fraudulent and fraudulent users. It also provides a dashboard for setting rules and seeing which rules have been violated when people make a purchase on your site. Stripe Radar can reduce fraud instances by up to 25%.

- Stripe Connect -The Connect product works on the online marketplace and sellers support over 100 currencies with the necessary conversion tools in the process. You can view a wide range of international sellers and configure automatic payment schedules for sellers selling in the marketplace.

- Offer coupons and free trials -Some of the best marketing tools you need are already in the Stripe payment processor. This means you can speed up your free trial period and offer seasonal coupons to new customers who prefer trading when starting up your company.

- Team Management -Many companies want to give payment processing and data access to other users in their organization. With Stripe, you have a team management tool to set up user rights so that others can see this information without going through a single account. You can easily manage permissions, and you can even integrate hardware tokens and two-factor authentication for added security.

- Option to build your own platform -Stripe supports building a completely unique platform, where the checkout process is much more original than the standard shopping cart and information collection page. For example, Lyft has a platform where payments are stored, but all are tracked based on mileage.

- Marketplace Support -Marketplaces are part of Stripe’s platform building part, but it’s a bit more streamlined with options to work with sellers, deliver instant payments, and set up a commission structure.

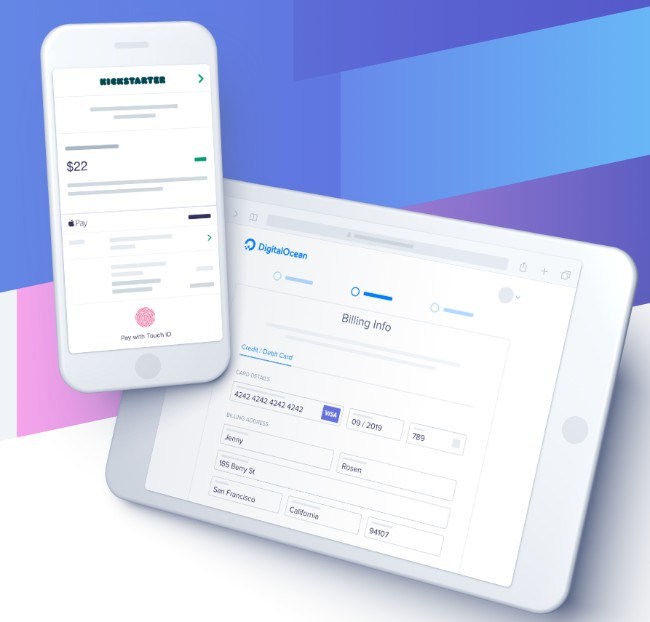

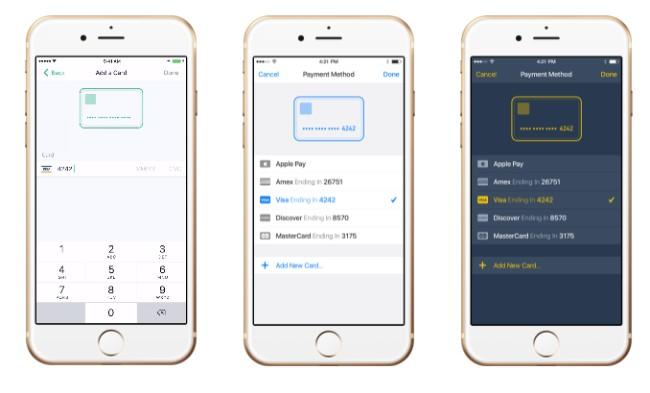

- Wallet Payments -Consumers are starting to pay using mobile wallets. So, Stripe supports options like Microsoft Pay, Google Pay, Apple Pay, Alipay and WeChat Pay.

- Mobile Commerce -Stripe Relay is similar, but the Mobile Commerce section encourages the use of Android and iOS apps, allowing you to collect payments from that app form. Customers provide the ability to store customer data in the app, allowing customers to make quick payments later. All statistics, payments and business details are on the mobile interface. Both Android and iOS versions are available.

Stripe Review: Fees and Extra Charges

As mentioned earlier, Stripe has a flat rate for every transaction. This makes it transparent and easy to understand.

With stripes that single flat rate is 2.9% + $0.30 .

The warning is that Stripe does not refund these transaction fees. So, if you refund to the customer, the corresponding transaction fee is lost to Stripe. This means that if a customer wants to return the product, they may have to eat this or charge a small fee.

The advantage of using Stripe is that it can support ACH. The transaction fee is 0.8% per transaction, up to $5.

Meanwhile, Stripe will support sellers in processing bitcoin payments. These transactions are subject to the same fees as ACH. However, as of March 23, 2018, Stripe has stopped all support for bitcoin processing.

How soon do you get paid?

Unless considered a high-risk company, Stripe pays most US sellers within three days. For companies outside the United States, the three-day payment system is still in effect.

What about a chargeback?

It is standard in this industry to charge $15 for all chargebacks. The stripes are no different. Stripe has an evaluation process for all chargebacks. The good thing is that Stripe will actually refund the $15 fee if the chargeback dispute is favorable. However, most sellers say this is very rare.

Which company is the best for Stripe pricing and fees?

The stripe price is reasonable and easy to understand. That said, it’s not the cheapest in many online stores. For example, some Exchange Plus plans are cheaper compared to certain companies. There are also many payment processors that offer discounts to certain brands, especially nonprofits.

The main advantage of the stripe is that there are no monthly and hidden costs. This is especially advantageous for small volume sellers.

In addition, Stripe has added support for microtransactions, paying more for transaction fees and reducing fixed fees per transaction. This is useful for artists, musicians, and others who sell digital goods. This is because it’s hard to eat the $0.99 transaction fee for an item that sells for $.0.30.

Contract and early termination

This is useful if you do not have a contract with Stripe and want to close your account early. In fact, Stripe has no hidden fees, making it one of the more transparent options.

Warning about chargeback

It is important to read the Terms of Service as Stripe states that you can suspend your account for any reason that Stripe deems worthy. So if you want more stability, Stripe may not be for you.

If your industry is considered high risk, Stripe may not be right for you. If you have a lot of chargebacks, Stripe may not be for you. In fact, Stripe says it doesn’t work for sellers with a chargeback rate greater than 1%.

That’s a tough number for online sellers.

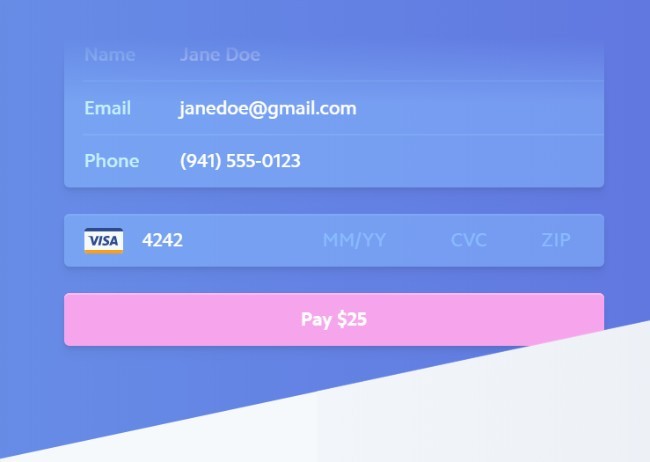

Difference between regular stripe and stripe element

The stripe element is actually integrated with the regular Stripe payment processor. Stripe’s core feature is collecting payments through an online store, while the Stripe Elements tool is a collection of pre-built modules to create customized checkout areas.

The Stripe Elements checkout page is created by the Stripe team for full optimization, localization, and real-time validation.

Simply put, you can easily get away from third-party hosted payment pages. Electronic commerce platform . The pre-built checkout module is optimized to increase sales and offers a stable price and reliable interface of a regular stripe system.

In addition, you can tailor the payment area to suit your brand. Elements work with much less code than usual and provide some of the best building blocks for creating your own checkout experience.

The stripe element is also PCI compliant.

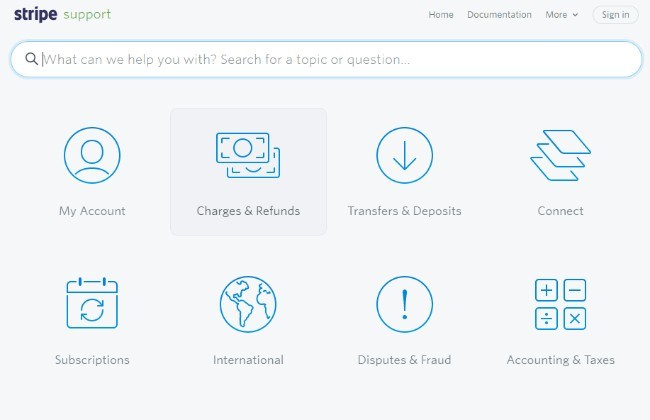

Stripe Review: Customer Support

The best part of Stripe customer support is its documentation and online resources. To get you started, the Stripe blog covers updates to the processor and how to implement some new features.

The development page contains information about all popular coding languages for the API reference module .

The Stripe Support area provides a knowledge base where you can find specific topics and find articles such as subscriptions, disputes, scams, accounting, refunds, and more.

There is also a document area for more advanced research.

When it comes to direct contact information, Stripe offers 24×7 phone and chat support. As this type of ongoing support is not common to payment processors, it has a very significant impact on online sellers. In addition, Stripe is moving forward to help their customers as they have not received phone support.

You can also contact the Stripe support team via email. Some languages supported via email include English, French, German, Italian, Japanese, and Spanish.

Comments on how Stripe Support treats customers is widely controversial. Some traders have good things to say, while others think it’s completely the opposite.

The same kind of discussion of customer support can be found in all other payment processors in the industry, so it usually depends on your unique experience. Not only that, as Stripe is a big and popular brand, it’s inherently bound to stumble on many good and poor reviews.

Who should consider Stripe as a payment processor?

By adding micropayment support, artists and people who sell digital goods can use the Striped . The average online ecommerce store owner can do it with Stripe, given that prices are standard and they don’t have to worry about hidden fees or multiple payment plans.

Not having to pay a monthly fee is also good for small quantity sellers.

Most of the West has access to Stripe Payments, but if your business is deemed too risky or too risky, it may be rejected or terminated by Stripe. Stripes do not support companies in certain areas. The same is true for online stores with a chargeback rate of 1% or more.

Apart from that, Stripe is perfect for developers and companies looking for full customization of their payment modules. You can use the API for complete, unified control, and the Stripe Elements builder supports your creative process.