You can choose the most amazing products, competitive prices and very successful marketing in your online store. However, you won’t be successful in the world of e-commerce until one more thing is right about being a payment gateway.

Payment gateways for e-commerce sites are a way to accept and process payments when customers visit online. Choose the Right Gateway Provide your customers with a reliable and reliable experience, making them feel comfortable with their purchases. If you choose the wrong payment gateway, you risk losing potential conversions forever.

So, how do you decide which tools you need?

Well, there are a lot of options out there, but when everything else fails, it is better to start with the most popular service. Stripe and PayPal are one of the most popular and trusted payment processors in the e-commerce market. .

That’s why we’ve put together this Stripe vs. PayPal comparison to help our customers choose a business they can trust.

Stripe vs PayPal: knowing the brand

Before comparing, we need some basic insights into both PayPal and Stripe brands. Fortunately, these companies are very easy to understand.

PayPal and Stripe are both payment processing strategies. PayPal is almost in the name of a household at this point, offering an endless way to send and receive money online (and offline). Stripe, on the other hand, is a professionally known payment processor with a name recognizable by more merchants than its customers.

PayPal and Stripe aren’t the only payment processing options available for today’s companies, but they are the two most powerful.

PayPal is an easy-to-use payment gateway that offers consumers multiple purchasing options today. You can use PayPal to run a full payment gateway or offer PayPal as an additional secure payment method for your website.

Striped Internet is one of the market-leading software platforms for businesses and online sellers. Stripe processes billions of dollars of transactions each year for businesses around the world.

Stripe vs PayPal: features and services

So we know that PayPal and Stripe are both payment processing solutions. But what exactly do you mean in terms of the features you will get?

First of all, let’s take a look at PayPal.

PayPal features and services

PayPal’s core focus is always payment processing. With this software, anyone can make a purchase using a debit card or their own online account. There are 3 ways merchants can participate in PayPal as a payment process.

- Add to Payment: The PayPal Checkout feature is an additional option that you can add to your existing payment page if your company has already accepted credit card payments using a different processor. This basically means that customers can pay for products via PayPal and a card or credit card.

- Payment Criteria: If you don’t have a payment processor set up for your business, PayPal can be the default processor. You can create a checkout button and copy/paste the code to your site to activate PayPal for your default shopping cart. There are many ways to customize the standard plan to your needs.

- Payments Pro: Payments Pro gives you access to all PayPal features for standard checkout, including additional features such as a virtual terminal and hosted checkout page. Hosted payment means you can keep your website when customers buy something without rerouting to your PayPal page.

In addition to processing payments, PayPal also provides access to: Here are the PayPal mobile service points system, online invoicing, donation buttons, bulk payment systems and more. PayPal also provides useful integrations with major POS systems so you can sell directly.

Stripe features and services

So, how does Stripe measure the PayPal experience?

The first thing to note is that there is no identical “Service Plan” approach to the feature package offered by Striped PayPal . You can use the basic Stripe payment processing features anywhere. The Stripes Payment processing tool includes access to:

- Credit card, ACH and local payment support

- Built-in in-app and online payment page

- Built-in pre-built checkout form

- Ability to fill out forms using “elements”

- Recurring billing, invoicing and subscription tool

Stripe also offers Stripe Terminal, a software development kit (SDK) that allows you to deploy Stripe’s payment processing capabilities into Point-of-Sale (POS) applications on web or mobile platforms. . The solution comes with pre-certified hardware products and a number of additional features that make it easy to carry out the integration process, including:

- Striped radar for anti-fraud management

- Issuing stripes for physical and virtual cards

- Stripe connection for market management

- Striped Sigma for SQL Business Intelligence

- Stripe Atlas integration for startups

Stripe vs PayPal: Transaction Cost / Fee

do not worry. After a while, we’re back to the feature set offered by Stripe and PayPal. However, before proceeding with the comparison, it is advisable to check the fees you can pay for both tools.

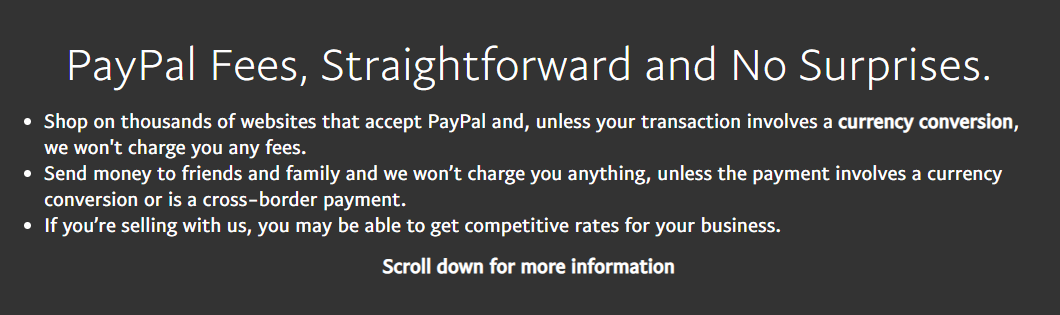

The first thing you need to know when comparing Stripe and PayPal is that you can start selling without monthly billing. You do not have to purchase a subscription to get started. This makes both tools useful for small businesses and start-ups starting online for the first time.

The base rates for Stripe and PayPal are very similar.

Both PayPal and Stripe charge for the transaction. 2.9% + $0.30c . That means you have to pay $3.20 for $100 per sale. Does it make sense?

Calculate the amount to be paid

With PayPal, you pay:

- 2.9% flat fee for adding PayPal buttons to your site

- 2.9% flat fee for adding PayPal to your payment

- 5% + 5 cents for micropayments

- 2.9% + 30 cents online sales

- 2.75% for chip and pin/contactless payments

- 3.4% + 30c when paid on Magnetic Stripe

With Stripe you pay for:

- 2.8% + 30 cents on basic consolidation purchase

- + 1% for international payments

- 0.8% for ACH trading

- 1% of immediate payout

- 2.9% + 30 cents at local payment

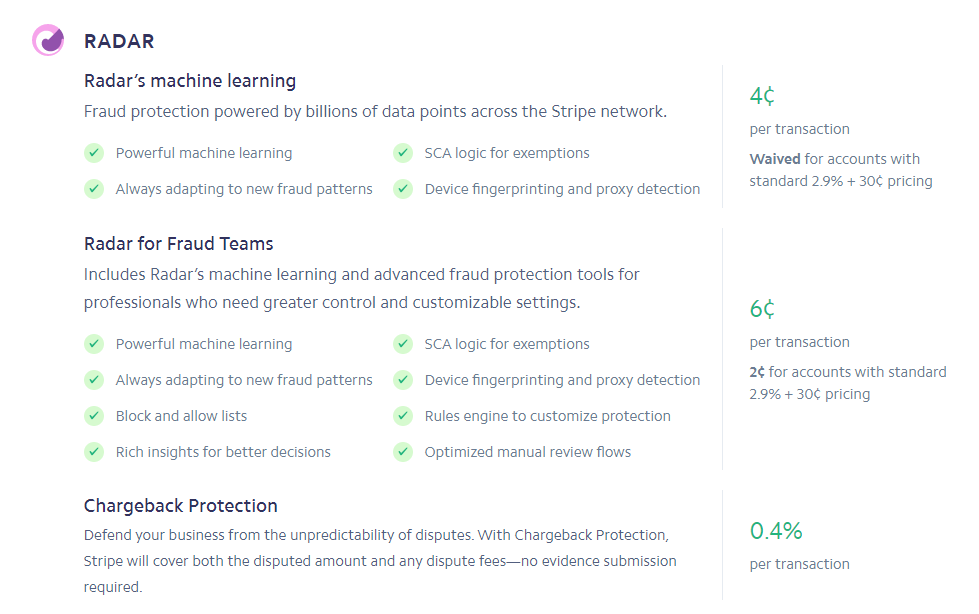

Stripe also offers custom pricing packages for businesses with specific payment processing needs. The price you pay for Stripe’s “add-on” depends on what you need. For example, billing and radar functions are charged at 0.04%, and the terminal is 2.7% plus 5c .

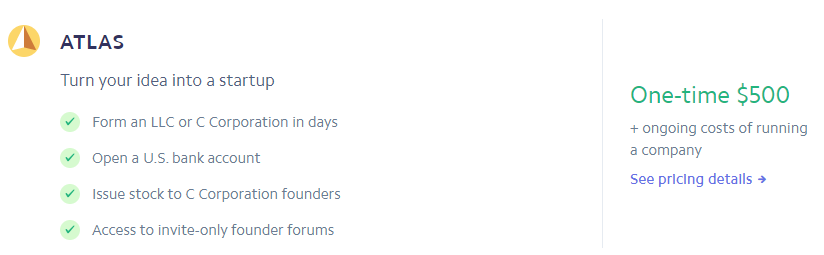

Ultimately, Stripe is a bit cheaper than PayPal for things like international payments, but you might pay more if you want to access additional features like Sigma and Radar. Access to Startups’ “Atlas” feature and founders forum, which comes with US bank accounts, has a 500-time payout price tag.

Stripe vs Paypal: Dispute/Refund Fee

In addition to basic transaction fees, Stripe and PayPal have their own strategies for handling issues like disputes and chargebacks. Chargebacks can do serious harm to any company, so this is something you should pay special attention to when building an e-commerce business.

PayPal chargeback and complaint fees include un authorized transactions, issues with items not received, and complaints about product descriptions and other items. When the chargeback begins, the amount is refunded to the customer and the seller receives a commission of up to $20. If the case is ruled in your favor, this fee will be refunded later.

Stripes take a very similar approach with a small refundable fee of $15. In addition, Stripe also offers its merchants an additional opportunity to reduce their risk of credit card fraud with Stripe Radar. Radar offers a variety of solutions, including machine learning, SCA logic for exemptions, rich business insights, and advanced chargeback protection. However, you have to pay extra to access the radar.

Stripe vs PayPal: website integration and setup

Having looked at the basic features, I talked about the cost. Now you can learn more about what PayPal and Stripe can actually do.

The first thing to consider when choosing a payment gateway is how easy it is to implement the solution on your existing website. PayPal is one of the most used payment processors in the world because it is easy for any company to start selling online. All you have to do is copy some code from PayPal site and paste it into your website. Upon completion, you will see the “Pay with PayPal” feature on the site.

You can also implement other PayPal buttons on your website, such as “Add to Cart” and “Buy Now”, or set them up for automatic billing. PayPal supports most CRMs through integration, so you can also link customer relationship strategies to payments.

If you are looking for a company that offers the best ease of use, PayPal is for beginners. The PayPal portfolio has several tools for developers, but you don’t have to go around the code to use this feature. Integrate various third-party e-commerce platforms and systems, and even create your own website with attractive payment buttons. If you can copy and paste HTML, PayPal is a good place to go.

For now, PayPal stripe doesn’t mean it can’t be windy. In fact, like PayPal, it is designed to make setting up your online merchant account as simple as possible. Stripe supports several CMS options than PayPal, and you can use the API’s Stripe plugin to integrate the system into your website.

If you have a convenient in-house developer, you can use our API system to integrate Stripe into every aspect of your website. Here’s a quick look at what it looks like.

Honestly, above all, if you’re looking for simplicity, I recommend using the plugin that comes with Stripe. You can easily integrate the system with your CMS and most websites. However, many people appreciate the deep developer options that Stripe offers. Coding options set this payment platform apart by offering more options for customization and integration.

If you’re a developer, there’s no question whether Stripe or PayPal is a better choice. PayPal offers a lot of features these days, but there is a lot more you can do with Stripe. Stripe has a beginner’s option, but it is designed for developers, and PayPal is designed for beginners (a few developer options).

Ultimately, neither PayPal nor Stripe makes it difficult to set up payments on your website, so it is difficult to compare the two in this case.

Stripe vs PayPal: Global Sales Strategy

Once you know how to set up the PayPal and Stripe systems, the next thing you need to do when comparing PayPal and Stripe is to take into account worldwide availability and supported currencies. After all, one of the best things about being an eCommerce seller is that you are free to sell to customers around the world, at least if your payment processor supports it.

PayPal Easily is one of the most popular payment processors in the world. You can buy and sell with PayPal in over 200 regions and countries. You can also track the specific countries you will sell. PayPal Worldwide Product Page Click Here.

Now, the reach of the stripes is a bit smaller than PayPal. Currently, payment services are available in 34 locations around the world -but the number continues to grow.

Something useful? If Stripe isn’t available in the country of your choice, here’s a workaround. You can use the’Atlas’ option (another cool add-on) to set up a US bank account and accept payments instead.

Additionally, PayPal removes Stripe when it becomes available globally, but Stripe outperforms PayPal when it comes to Supported Currencies. You can conduct and manage more transactions than the striped 135 currency. Of course, many merchants agree that supported countries are more important than supported currencies.

This makes PayPal the winner this round.

Stripe vs PayPal: acceptable payments and payment plans

Now you know where you can accept payments using PayPal and Stripe. Let’s see what payments are accepted.

PayPal allows e-commerce stores to instantly accept all major credit and debit cards. PayPal users can store PayPal credits online and keep them available on any website without having to connect to a bank account.

PayPal also offers a useful feature of “PayPal Credit”. This is a line of credit that can be used by customers in the US and elsewhere in the world. You must be at least 18 years of age to redeem your credit, but it gives your customers another way to purchase items through PayPal. The more different payment methods you need to use, the higher your chances of conversion.

It’s worth considering the value of PayPal’s active registered cash account and credit account when comparing your payment options to those available on Stripe. In the end, Stripe puts payment solutions out of the park by accepting everything from AliPay and Apple Pay to Google Pay, MasterCard, Visa Checkout and WeChat. If you can think of a payment method, Stripe will probably take it. Of course there is no option to pay with PayPal-this is a slight downside.

Ultimately, it is difficult to choose a winner with only acceptable payment options. You need to know more about the types of payment options your customers use to determine if Stripe or PayPal is right for you. For example, Visa and MasterCard charge around 80.10% of their target market, so having Stripe’s MasterPass and Visa Checkout options is a huge advantage.

However, Paypal If you have access to your PayPal account and PayPal Credit, you can create a PayPal as a more attractive option for your business.

Another key thing to note is the option to use a payment plan.

The payment plan makes high-ticket items much more attractive to customers who want to buy an item but don’t have the money to hand over all the cash at once. For example, when Vrai and Oro (jewellers) started offering payment plans to customers, their annual sales reached 20,000 dollars.

Payment plans are obviously strong for companies looking to sell more expensive items or premium inventory. However, you need to make the payment gateway simple to set up your payment plan. Luckily, PayPal provides a lot of documentation and guidance on developing the payment process and using the Setup Plan button.

Unfortunately, it hardly makes striping things simple. You can only set up a payment plan through Stripe using a subscription system that is not sleek or intuitive. You will need a developer to make sure everything is working properly.

If you only have payment options, PayPal has an edge over Stripe when it comes to payment options.

Stripe vs Paypal: the payment experience

Another key thing to consider when comparing PayPal and Stripe is the kind of payment experience to offer to your customers. After all, the customer experience these days is the most important differentiator for any business. If you can provide your customers with a great payment experience, you’re more likely to convert all your visitors into repeat customers.

The payment experience provided through the website directly affects the user experience and usability of the website. Fortunately, Stripe’s payment process is very simple. Customer enters credit card information and enters views. Hey, Presto! They have completed the purchase. The flow and design of your payment is entirely up to you.

Paypal, on the other hand, makes things a little less complicated.

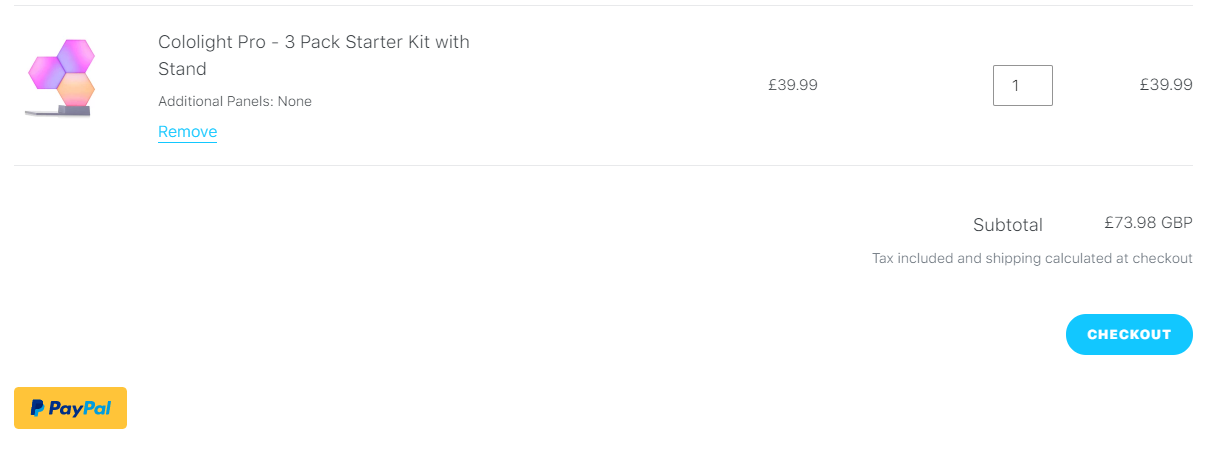

Imagine trying to buy a light from Cololight.co.uk. When you go to the checkout page, you will see two buttons: checkout and paypal.

Click Checkout to add your credit card number and details for full payment experience. Tapping PayPal will take you to a separate PayPal login page to complete the transaction. Usually, customers have to wait a few minutes for the PayPal payment page to load. It can also confuse some customers if it is thrown from your website to another window.

You are still dealing with a brand you trust (PayPal), but it may not be safe to pass the payment details when your customer leaves the initial site.

With just the extra clicks involved in making payments through PayPal, you can be confident that your prospects don’t want to buy. You need to enter your PayPal details, click on the payment details you want, then go back to the website and complete if you have any questions. It is far more tiring than is necessary in today’s age of instant gratification.

PayPal’s process has some additional questions for users such as:

- How long does it take before clicking the refresh button?

- Was the payment completed?

- Where do I put the discount code?

These may seem small, but they can have a significant impact on your conclusions.

Stripe vs PayPal: customer service

Now we have come to a critical but often overlooked component in determining the payment processing system you need. When comparing PayPal and Stripe, you need to make sure you get a lot of support from the company you’re buying from.

It comes with a variety of service options, including a comprehensive help center full of answers to recent PayPal questions, for example . The Help Center supports everything from approval of payments to issuing refunds. Other options are:

- Community Forum : A place where you can talk to other experts in your landscaping or find community users who are experiencing similar problems with you.

- Live Chat : Live chat is becoming an increasingly valuable addition to the PayPal customer service experience. Being able to chat with your rep in one moment is a fantastic add-on.

- Email support : If you don’t need an answer to your question, you can email the PayPal team. You can only send emails if you can still log in to your PayPal account.

- Developer Center : PayPal doesn’t focus on developers like Stripe does, but if you like the code, you still have information.

PayPal also has its own social media account designed specifically for customer service. For example, an account linked to Twitter @AskPayPal will answer your questions from 9:00 AM to 5:00 PM CST. Unfortunately, it doesn’t really help much if you don’t suffer from a specific problem until you run into problems later.

Stripe has recently been updated with more attractive and comprehensive customer support options. The new solution offers features like free 24/7 live support for all traders. This is a big problem for most people. After all, one of the major problems with merchant customer service solutions is that they can’t reach the people they need when trying to talk in real time.

Stripe’s three-hour chat and phone support makes the brand a little more attractive than PayPal when it comes to consistent service.

Overall, like Striped PayPal, it has a lot to offer, including a knowledge base that guides customers through account basics. The knowledge base is not as comprehensive as PayPal until you switch to the developer side.

Even if you’re not really a developer, Stripe’s developer documentation provides detailed information on what you can do with certain features. Other features include:

- Chat-based support (Freenode-based). If you want to reach out to the Stripe developers and ask technical questions, you can find an expert in the IRC chat section. Here you can connect with experts who will help you build the perfect website.

- Live Chat Support: The Stripe live chat support system is completely different from the free node solution. Log in to your account and visit our Contact Us page to get in touch with a support representative for all of your most important questions, whether developer-focused or not.

- Phone Support: If you need real human help, you can ask Stripe to call you when an agent is ready. This offers a huge advantage over PayPal’s phone support option.

- Email support: For less urgent queries, you always have the option of sending a message to Stripe via email. This is often one of the simplest ways to get a response from the Stripe team as quickly as possible.

Although I won’t be able to contact them via @Stripe or @StripeStatus as I don’t have a dedicated account for customer support on PayPal social media. Twitter. There is also a Stripe Facebook page.

There are many customer service options available for both Stripe and PayPal. However, both companies are having trouble providing their customers with the support they really need. PayPal continues to struggle to deliver great experiences. Sometimes you may be able to reach out to a helpful representative, but in other situations you may be on hold for hours and chat with people who are unable to help.

Or Stripe had the problem of being able to reach real people when they really need it. You could call and email companies in the past, but by 2018, live chat and phone calls were introduced, starting to change the customer service experience.

Stripe vs Paypal: Verdict

So how do you know if Stripe or PayPal is your best choice when making your final choice? As we have seen in our comprehensive comparison, each company has its own pros and cons. PayPal, for example, is great for micropayments and great for beginners who don’t want to deal with code. Additionally, PayPal offers excellent payment planning options when you want to decentralize your customers’ purchases.

On the other hand, stripes looking to renew their previous approval to extend their stay in the United States are probably one of the best options for custom e-commerce stores. Having a WordPress account makes setting up a Stripe environment very easy. Plus, if your team has developer skills, you can do more with Stripe and more with PayPal. Stripe offers more payment options and dozens of great integrations.

However, both services sometimes struggle with customer service, and neither is 100% suitable for you. If possible, we recommend testing the free version of both tools and seeing which ones you click the most before rolling out. At the same time, remember that there are many alternative payment solutions out there, including options like Square, one of the best POS choices on the market.